What do you want for your grandchild’s brightest future?

Help light their path ahead—and reach their future goals—by opening or contributing to an NC 529 college savings account. Earnings grow tax-free. It’s flexible. And it helps illuminate a world of opportunities for your grandchild. Making you the best grandparent ever.

What is the NC 529 Plan?

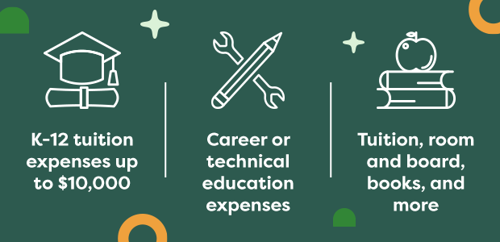

An account in the NC 529 Plan forges a way forward. It’s a tax-advantaged saving and investment program that can help make college a reality, allowing your grandchild to prepare for education expenses, including K-12 tuition, college costs and more. It makes saving for future education simpler and more attainable. And above all, it’s a legacy you’ll leave with them—giving them confidence and a plan for success.

The benefits of a 529 account for your grandkids

Median weekly earnings for those with a bachelor’s degree were 68% higher than those with only a high school diploma, according to the Bureau of Labor Statistics. An NC 529 savings account helps make that educational success happen for your grandchild. Earnings can be applied in multiple ways, in any stage of their growth.

How can I get started?

Nearly anyone can open an account. It’s easy and only takes minutes. The minimum starting contribution ($25) goes directly into the account. No fees are involved. And if you’d prefer not to open an account, you always have the option to give a gift to an existing NC 529 account.

Still have questions? We have answers.

Yes. You can change the beneficiary of the account at any time to another grandchild or to someone else related to your original grandchild who plans to attend college; unless the account was established as a custodial UTMA/UGMA 529 Account.

No. The grandchild is not required to attend college in North Carolina in order for the withdrawals to be considered qualified. The NC 529 Plan is valid nationwide regardless of state of residency for the participant/owner or student and the student can attend any eligible institution for qualified withdrawals. There are no penalties or additional charges for out-of-state or foreign eligible institutions.

Many ways. 529 Account funds can be used to cover a variety of qualified educational expenses your grandchild might have, such as: tuition and fees; books, supplies and equipment; room and board expenses for students enrolled at least half time; computer or technical equipment; and special needs services for any special needs students.

No problem! You won't lose access to your money. Simply request a withdrawal from the account in an amount equal to the scholarship or tuition waiver. The earnings portion of such withdrawals will be subject to federal and state income taxes.

A 529 Account held for the benefit of a dependent student is currently reported on the Free Application for Federal Student Aid (FAFSA) as a parental asset. This treatment of 529 assets is generally considered beneficial since parental assets are assessed at a much lower rate than the student's assets in determining the expected family contribution, however, federal financial aid rules are subject to change. The student and parent should talk with the financial aid officer at the college the student will attend for more specifics since the amount the family is expected to contribute towards college costs can vary based on income, age of the older parent, grandparent, the number of dependents, and other factors.

No, grandparents are not eligible for a North Carolina tax deduction on contributions made to parent-owned accounts. But your grandchild will be able to make federal and state tax-free withdrawals to pay for education expenses, such as college tuition, assistive learning technology, and so much more. Just remember that the sooner you contribute to an account, the more time that investment has to grow.