Tight Budget? You Can Still Save for College.

Saving for a college education for your children is more important than ever, but on a limited budget, putting away money every month can be difficult. But the reality is that whatever amount you can save for a college education can help. Money you put away is an investment in your child’s future and opening an account in the NC 529® Plan will get you started.

Why Save in an NC 529 account?

You can open an NC 529 account with a starting deposit of only $25 and make future deposits at the same minimum $25 or add more when you can. There are no enrollment fees or sales charges to open your account. If you’re getting a $5 coffee once a week, consider putting that amount aside until you have $25 to put into your NC 529 account — and keep it up. You’ll be on your way to saving for college.

Another advantage of opening an NC 529 account is that earnings are free from federal and North Carolina income taxes when you use your money to pay for qualified higher education expenses. You can contribute on occasion or regularly by check, automatic payment, or payroll deduction, if your employer offers.

What is the best way to invest my money?

You can choose from various investment options that range from conservative to aggressive in the NC 529 Plan. There are age-based and individual options; choose one or the other or both types of investments.

An age-based investment option takes into account your child’s age and the number of years before he or she will go to college. You pick whether you want to invest conservatively, moderately, or aggressively and then the Program administrator will automatically move your assets from one Investment Option to another as your child (who is the beneficiary on your account) gets older.

An age-based investment uses these age bands: Newborn – 5 years, 6 – 10 years, 11 – 15 years, 16 – 18 years and 19 – older. When your child reaches the limit of the age band in which he or she was first placed, the exchange to the next age level is made on the beneficiary’s birth date, or the business day that follows it, if the birthdate is not on a business day.

Individual options do not change asset allocations based on the beneficiary’s age; they are fixed over time. Whichever investment options you choose, you should consider the amount of time you have to save and the amount of risk with which you feel comfortable. The Program Description that outlines each offering is available at NC529.org. You can make changes to your current investments twice a year if you want or keep them same if you want. You can change investments for future contributions any time.

What can I expect to earn?

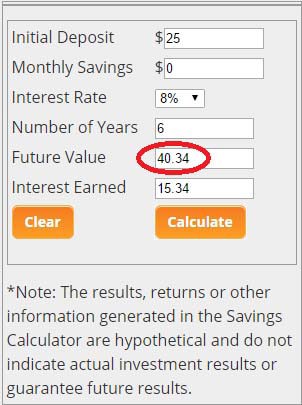

You can set your own goals for contributing to your NC 529 account. Use our simple savings calculator to try out different amounts and times. For example, if you start with just $25 and don’t deposit a single dollar more, you potentially could nearly double your initial deposit and end up with $40 in only six years using an aggressive fund with an 8 percent interest rate.

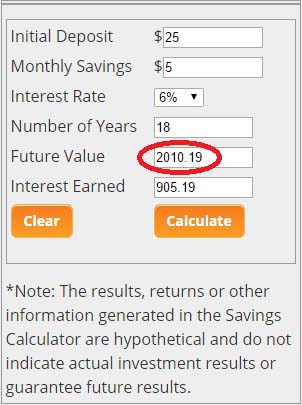

Try another scenario to see what making additional contributions can do. Start with a $25 deposit, and make $25 contributions every 5 months (by putting aside $5 each month and contributing $25 to your account on the fifth month), estimating a 6 percent interest rate over 18 years. How does that look?

*There is a $25 minimum contribution to your NC 529 account. The $5 monthly savings amount indicates $5 put aside each month, to be contributed to your NC 529 account in a lump $25 sum every fifth month.

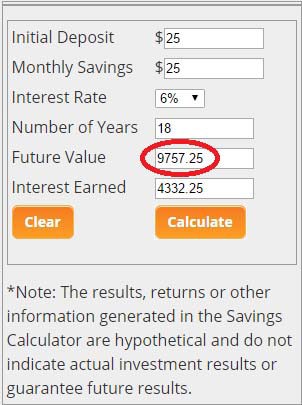

And if you increase your contribution amount to $25 a month, look at the difference.

The NC 529 Plan allows you to adjust your contribution amount at any time. You can decrease or stop your contributions during times when you need the money for other expenses, and then increase them when you are ready to add to your account again. Whatever amount you have in your NC 529 account will be available to help with your child’s college expenses.

In addition to your contributing to your NC 529 account, other family and friends can too. The minimum contribution amount is still just $25 and a grandparent or other family or friend’s contribution to your account for your child can be a gift for your child’s future. There is no right or wrong way to save for your child’s college education in an NC 529 account, just put away whatever you can.

Whatever you save can help with books, tuition, or other college expenses. Plug in your own numbers in our simple savings calculator to find a savings goal to fit your budget. Our College Savings Planner can also give you more information to consider.