Paying Off Student Loan Interest While in School: Is it Worth It?

While you're working hard in college, making lifelong friends, and pursuing your degree, you may not be thinking about paying back your student loans. After all, that could be years from now, especially if you're a freshman. While it's technically correct that you don't have to think about student loan payments until after graduation, you may want to think about student loan interest now.

For the class of 2018, nearly 69 percent of graduates had student loans, and the average amount of loans per student was $29,800. The good news for students and parents is that student loans do not need to be paid back until after you graduate or fall below half-time status.

However, loans accrue interest while you're in school. So, by the time you graduate, the unpaid interest could add hundreds or even thousands of dollars to your original loan amount. Because of that, you may want to consider paying off student loan interest while in school.

Benefits of Paying Interest While in School

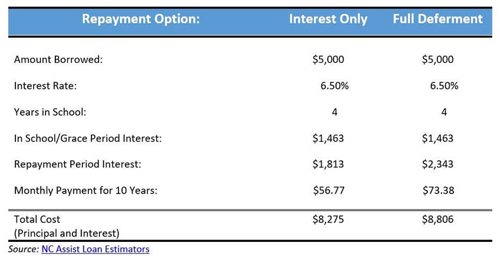

The table below shows what happens if you choose to pay the interest on a $5,000 loan during school and what happens if you choose to defer the interest. Over the life of the loan, you could save more than $500! Paying off student loan interest while in school also can reduce your monthly payments once you enter the repayment period.

So, if you're not paying interest, it's being added to the principal amount you originally borrowed. Adding interest will continue to increase the amount you'll have to pay back once you enter the repayment period of the loan.

After four years of college, that could be a significant increase from the amount of the original loan. It may be wise to consider paying off student loan interest while in school if the payments work with your budget.

Is There a Downside to Paying Student Loan Interest Early?

Money is tight for college students. Don't make things worse by sending your loan provider a chunk of money you can't afford. Take a good look at your budget and make sure you have enough funds to pay for things you need right now, such as books, rent, and food. While paying interest on student loans while in school is a good idea, it's still optional.

There are no pre-payment penalties on federal or private student loans. So, if you have the extra money there is no downside to paying loan interest while still in school.

Borrow Only What You Need

The decision to borrow money for college should not be taken lightly and shouldn't be your first resource when it comes to paying for school. Remember to complete the Free Application for Federal Student Aid (FAFSA) every year you plan to enroll. It will qualify you for federal and state financial aid, including scholarships, grants, and loans.

Apply to as many scholarships as possible. Earning an extra $500 here and there can really help make ends meet. Consider getting a part-time job during the school year. If a set job schedule just won't work with your school schedule, there are more flexible jobs you can do when it's convenient for you. Consider tutoring, working as a rideshare driver, or pet sitting.

After calculating available resources, you still may not have enough money to cover all your education expenses. NC Assist Loans can help students bridge the financial gap and achieve their college dreams. NC Assist Loans are offered by College Foundation, Inc. (CFI), a North Carolina-based nonprofit lender.