College Resources & News from CFNC

filters:

April is Financial Literacy Month. The goal of Financial Literacy Month is to help Americans become savvier when it comes to their money. From creating a budget to learning about investing, this is an ideal time to pause and evaluate your family’s level of financial knowledge.

One of the most common questions parents have about an NC 529® Plan is when should I set up an NC 529 Account? It’s a simple question with a straightforward answer — now! That’s because it’s never too early to start saving for your child’s higher education.

When it comes to saving your money, it’s important that you understand how a college savings vehicle works. We know that investing in a savings account for college can be a little confusing, especially if you are not familiar with financial jargon about your investment.

New Year’s Resolutions are all about improving your life and making plans for a better future. Of course, we all want to be grateful, healthy, and good to those around us. The beginning of a New Year is also a great time to consider financial and future goals.

As parents, we always want the best for our children. But in the busy eighteen years from birth through high school graduation, sometimes preparation for a child’s future higher education gets put on the back burner.

From baby’s first gurgle or giggle, parents begin to dream of their child’s future and try to figure out how to handle the associated costs of parenthood. Some parents immediately dive into saving for their child’s education.

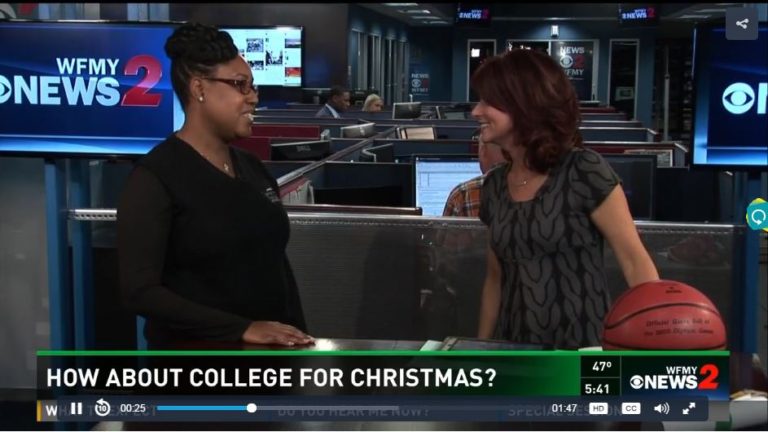

During the holidays and on special occasions, it’s fun to spoil the children in our lives. Twenty-five dollars can buy a variety of gifts – balls, gift cards and games. As WFMY notes, it can also give the gift of education.

The US News and World Report recently featured a Durham, NC grandfather who is helping his family save for college. Instead of giving physical gifts during the holiday season, he is contributing money to his grandson’s college savings plan each year. And, he’s not alone. According to the article, 84% of parents would prefer that their children receive money for college in place of physical gifts during the holidays.

Holiday giving can be tricky. Each year children receive a pile of wrapped items that they plow through quickly and inevitably forget after a brief period of time.

This holiday season, give your loved one a meaningful present that can be cherished for years to come — the gift of education. Most children receive trendy toys or clothes that will be lost, forgotten or outgrown within months or even weeks. Think outside the box and give a gift with true, lasting value.