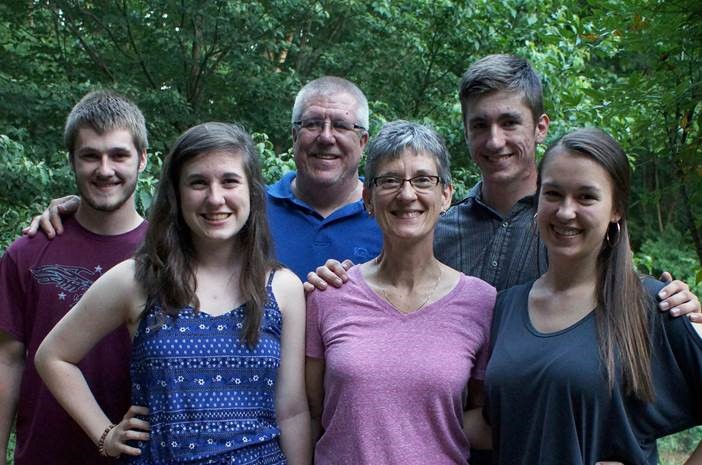

Congratulations to College Savings Day Winner Tim Towner of Gastonia, North Carolina!

Congratulations to Tim Towner of Gastonia, North Carolina! The contest, “Celebrate 5/29 and Win $5,529 for College!”, selected Tim Towner’s name at random from a large list of entries. Towner will receive his prize as a contribution to his children’s NC 529 Accounts. The contest was sponsored during the month of May by College Foundation, Inc. (CFI), a North Carolina nonprofit. College Savings Day was also celebrated by other states to encourage families to set aside money for higher education.

“We started saving about 20 years ago, through regular payroll deductions at my company,” says Towner. “It was important for us to work hard and save money for the kids, so they could decide what they want to do with their education.”

Towner and his wife, Judith, have four children. Each kid has their own NC 529 Account. Sarah, age 24, was the first to benefit from her parent’s savvy financial decisions. She graduated from Wingate University in 2017. Towner says that Sarah’s NC 529 Account covered about half of her college expenses. She also worked and took out student loans to pay for school.

“She has some loans,” says Towner. “But the college savings account made paying for school more manageable and we’re happy about that.”

Achieving Dreams at Home and Abroad

The Towners used NC 529 savings to pay for technical school and community college tuition for 22-year-old Simon. Jacob and Julia, 20-year-old twins, are also in college. Jacob is attending Wingate University in the fall. Julia is enrolled at Elon University and will study abroad this fall at Heidelberg University in Germany.

“The 529 Plans allowed Julia to study abroad and also helped pay for Sarah’s school-sponsored trips to South Africa, Cambodia, and Europe because the trips were part of their college tuition,” says Towner.

NC 529 earnings that are used for qualified expenses like tuition, room and board, and books, are not subject to North Carolina or federal taxes. The money grows tax-free if used for qualified education expenses.

NC 529 Plans are a Smart Way to Save for School

Towner is a big believer in the NC 529 Plan. He says they started saving small amounts every month, gradually increasing the contributions as their income allowed. He also likes that money from one kid’s account can be transferred to a sibling’s account to meet everyone’s needs.

“That’s the beauty of the accounts if you have multiple kids. If one kid is not using the money, others can,” says Towner. “I’ve always told people to look into a 529 Plan for their kids. It’s a great way to put money away for college.”

CFI congratulates the Towners, and thanks to everyone who entered the contest. Everyone wins when families plan and save for college. Anyone can open an NC 529 Account with as little as 25 dollars. NC529.org has additional resources, including a savings calculator, to show families how regular investments can grow into important resources for higher education.